The Least Expensive Cars to Insure: A Comprehensive Guide

Car insurance can often make up a significant portion of the overall cost of owning a vehicle. If you’re looking to save money, one of the best ways to reduce your expenses is by choosing a car that’s cheap to insure. In this article, we’ll explore the least expensive cars to insure, and help you understand how insurance premiums are calculated.

Car insurance premiums vary greatly based on a variety of factors. The make and model of your car, its safety features, and the cost of repair can all influence how much you’ll pay for coverage. It’s important to understand these factors when selecting your next vehicle, as it could save you a lot of money in the long run.

For more insights on how car insurance works, check out Insurance Information Institute and learn about how rates are determined.

Factors That Affect Car Insurance Rates

Several factors can determine how much you will pay for car insurance. Understanding these can help you choose a vehicle that offers both low purchase price and low insurance premiums:

- Vehicle Type: Sedans, hatchbacks, and compact cars are generally less expensive to insure compared to sports cars or luxury vehicles.

- Car’s Age and Model: Newer cars with advanced safety features may cost more to insure. On the other hand, older vehicles often have lower premiums due to their reduced value.

- Safety Features: Cars equipped with advanced safety features like airbags, anti-lock brakes, and anti-theft systems tend to lower insurance costs.

- Repair Costs: Vehicles that are expensive to repair or replace (like luxury or imported cars) usually have higher insurance premiums.

- Driver’s History: A clean driving record, age, and driving habits can significantly impact your premiums.

You can also explore further details on how to lower your premiums by using tools like Consumer Reports.

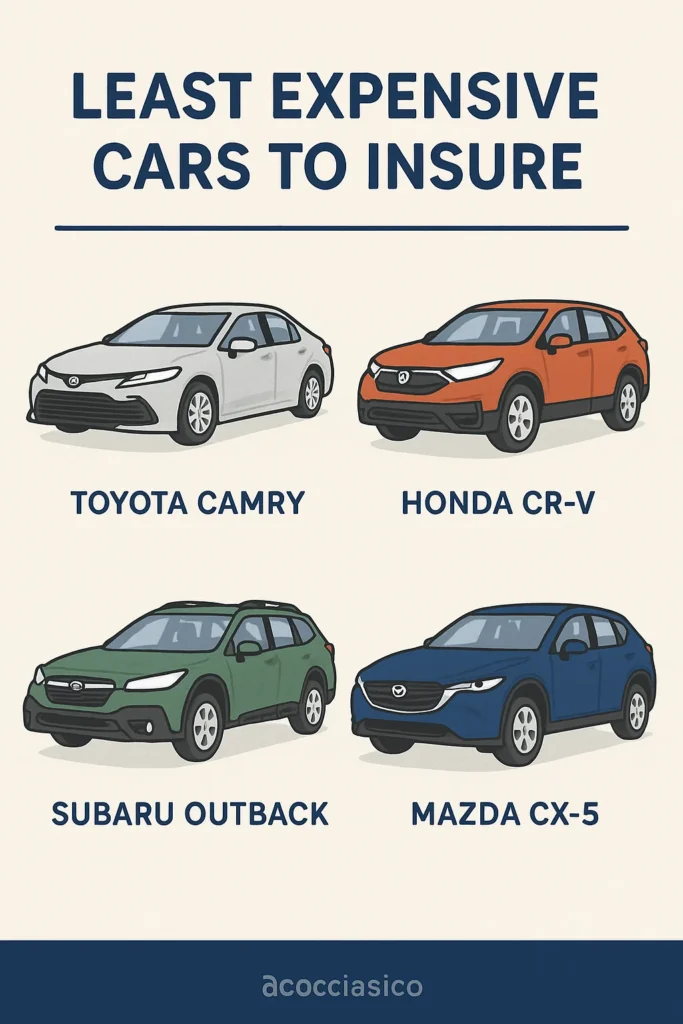

Top 10 Least Expensive Cars to Insure in 2025

Here is a list of the top 10 least expensive cars to insure. These vehicles not only have a reputation for safety but are also known for their affordability in terms of insurance rates.

1. Honda Civic

- Reason for affordability: Commonly available parts, excellent safety record, and low theft rates.

- Average annual insurance cost: $1,200.

- Why it’s cheap to insure: The Honda Civic is known for its reliability and safety, reducing the risk for insurers.

2. Toyota Corolla

- Reason for affordability: Low repair costs and exceptional safety ratings.

- Average annual insurance cost: $1,150.

- Why it’s cheap to insure: A dependable and safe vehicle, the Toyota Corolla’s high safety ratings lead to lower premiums.

3. Subaru Outback

- Reason for affordability: Excellent crash test scores and low repair costs.

- Average annual insurance cost: $1,300.

- Why it’s cheap to insure: The Subaru Outback is known for its high safety scores and reliability, making it a great option for affordable insurance.

4. Jeep Wrangler

- Reason for affordability: Low theft rates and fewer accidents.

- Average annual insurance cost: $1,400.

- Why it’s cheap to insure: The Jeep Wrangler’s low accident frequency and simple design contribute to affordable premiums.

5. Ford F-150

- Reason for affordability: High availability of parts and low repair costs.

- Average annual insurance cost: $1,450.

- Why it’s cheap to insure: The Ford F-150’s durability and low theft rates help to keep insurance premiums manageable.

6. Chevrolet Equinox

- Reason for affordability: Great safety features and affordable repair costs.

- Average annual insurance cost: $1,350.

- Why it’s cheap to insure: The Chevrolet Equinox has an impressive safety record and moderate repair expenses.

7. Hyundai Elantra

- Reason for affordability: Simple design and low repair costs.

- Average annual insurance cost: $1,100.

- Why it’s cheap to insure: The Hyundai Elantra is a compact car known for its reliable nature and affordability.

8. Kia Soul

- Reason for affordability: Small vehicle with low-risk of accidents and affordable repairs.

- Average annual insurance cost: $1,050.

- Why it’s cheap to insure: With its small size and good safety ratings, the Kia Soul remains one of the least expensive vehicles to insure.

9. Mazda 3

- Reason for affordability: Great safety ratings, lower repair costs.

- Average annual insurance cost: $1,200.

- Why it’s cheap to insure: The Mazda 3 offers a balance of safety and reliability, making it inexpensive to insure.

10. Nissan Altima

- Reason for affordability: High safety features and affordable repairs.

- Average annual insurance cost: $1,250.

- Why it’s cheap to insure: Known for its solid build and safety features, the Nissan Altima offers affordable coverage rates.

How to Lower Your Car Insurance Costs

Even if you choose one of the cars listed above, there are additional strategies to further reduce your premiums:

- Increase Your Deductibles: Higher deductibles generally lower your premiums. Just be sure you can afford the out-of-pocket costs if you need to file a claim.

- Take Advantage of Discounts: Many insurance companies offer discounts for good drivers, low mileage, and bundling multiple policies.

- Choose the Right Coverage: For older cars, you might not need full coverage. Opting for liability coverage may save you money.

- Maintain a Clean Driving Record: A clean driving record typically results in lower insurance premiums.

For more ways to reduce your insurance costs, visit trusted sources like Consumer Reports for detailed tips.

FAQs About Car Insurance Costs

1. What car insurance is cheapest for young drivers?

Cars like the Honda Civic, Toyota Corolla, and Mazda 3 are typically affordable for young drivers due to their safety features and low repair costs.

2. Which cars are cheapest to insure for seniors?

Seniors tend to find that cars like the Hyundai Elantra and Mazda 3 offer low premiums due to their compact size and strong safety records.

3. Does the color of the car affect insurance rates?

No, the color of your car does not directly affect your insurance premium. What matters more are the car’s make, model, and safety features.

4. Can car insurance premiums change after buying a car?

Yes, premiums can change depending on the car’s value, safety features, and repair costs. Always compare rates before purchasing.

5. How do I compare car insurance quotes?

You can compare quotes by visiting multiple insurance websites or using online comparison tools. Be sure to compare the same levels of coverage for an accurate comparison.

Conclusion

Choosing a car with low insurance premiums is a smart financial decision. Vehicles like the Honda Civic, Toyota Corolla, and Mazda 3 offer not only affordable purchase prices but also lower insurance costs, making them great options for budget-conscious drivers.

Keep in mind that your individual driving habits and the coverage you select also play a role in determining your insurance rates. By understanding these factors and following tips to lower your premiums, you can save money on car insurance over time.

For additional information on how to choose the best insurance for your needs, check out Consumer Reports and Insurance Information Institute.